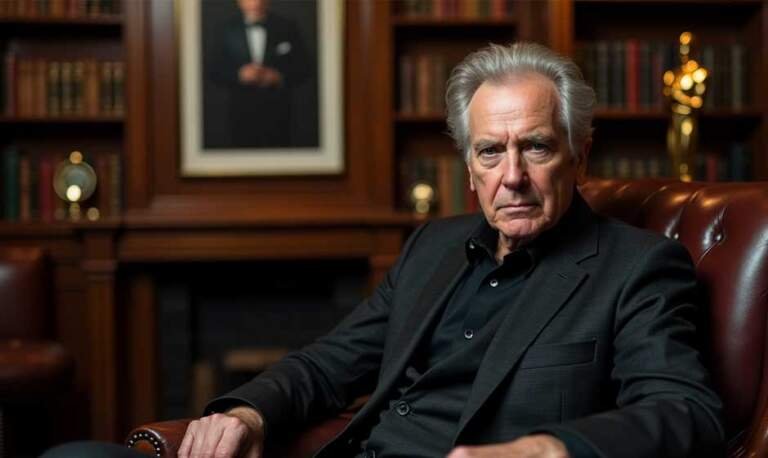

Many people know Anthony Scaramucci from his 11-day stint as Donald Trump’s White House Director of Communications in July 2017. But “The Mooch” has quietly built an impressive fortune, now worth $90 million.

His short political career might have grabbed headlines, but Scaramucci’s financial success tells a more compelling story. The launch of SkyBridge Capital in 1995 marked his rise in the financial world, and the firm grew to manage over $7 billion in assets at its peak. The company later faced tough times when a 40% negative return led clients to pull out 60% of the fund’s capital, dropping assets to $1.3 billion by late 2022. Scaramucci’s wealth today consists of $85 million in liquid assets and smart investments. His stake in the New York Mets stands out as a brilliant move that grew from $20 million to about $80 million. This piece explores how a Wall Street trader became a financial powerhouse through calculated risks and strategic investments.

From Long Island to Harvard: The Early Years

Anthony Scaramucci’s life began in a modest corner house on Long Island on January 6, 1964. Nothing about this humble beginning hinted at his future financial empire. His Italian-American family’s roots ran deep in blue-collar work. Alexander, his father, operated a crane for 42 years in local sand mines. These mines supplied Manhattan’s skyscrapers—the same Wall Street buildings where his son would later build his fortune.

Young Anthony grew up with two siblings in a middle-class neighborhood and developed his trademark charismatic personality. His high school years at Paul D. Schreiber showed his natural leadership abilities. He became student body president, quarterbacked the football team, and earned the nickname “The Mooch” from classmates who admired his confidence. His entrepreneurial spirit emerged early when he started delivering Newsday newspapers at age 11. He added his personal touch by walking up to porches to provide what he named the “Scaramucci Touch”.

Scaramucci’s childhood experiences shaped his ambitions clearly. “I knew as a kid I needed financial stability. I needed financial independence,” he later reflected. He broke new ground as his family’s first college graduate, earning an economics degree from Tufts University in 1986 with summa cum laude honors. His distinctive Long Island style—leather motorcycle jackets, boots, and gold chains—made him stand out among his peers at Tufts.

Harvard Law School marked the next chapter in his education, where he shared the class of 1989 with future luminaries Barack Obama, Rod Rosenstein, and Neil Gorsuch. The construction worker’s son became known for questioning the institution’s pretensions. His parents expressed their pride through a yearbook note: “To Anthony with love, pride and congratulations. ‘To the victor go the spoils.'”.

Scaramucci never practiced law despite his legal training. He chose Goldman Sachs right after graduation, starting the financial career that would build his considerable net worth. His path from Long Island to Harvard marked his first vital steps toward becoming a billionaire.

Wall Street Climb: From Goldman Sachs to SkyBridge

Scaramucci’s Wall Street trip started with a spectacular stumble. He joined Goldman Sachs in 1989 but lost his job after just 18 months on February 1, 1991—a date he never forgot. “I was crestfallen,” Scaramucci remembered that turning point. “I had just graduated from Harvard Law School, this was my first big job, I had school debt, and I was panicked”.

With an $11,000 severance check and a roll of quarters to make payphone calls, Scaramucci networked his way back to the same firm relentlessly. Goldman Sachs hired him again in March 1992—this time in sales, where he truly excelled. He ended up becoming vice president in Goldman’s private wealth management division during his seven-year stint.

Scaramucci’s entrepreneurial spirit led him to co-found Oscar Capital Management with Andrew Boszhardt Jr. in 1996. The firm provided investment advice to wealthy individuals, families, and foundations. Their venture turned into a soaring win, with assets growing beyond $800 million under management. His mentor, renowned investor Mario Gabelli, gave vital advice when Scaramucci thought about selling Oscar: “Anthony, when they’re passing out cupcakes, if you don’t take them, you’re not going to get them again”.

Taking this advice, Scaramucci sold Oscar Capital to Neuberger Berman in 2001. Neuberger’s acquisition by Lehman Brothers followed, where Scaramucci served as managing director until 2005.

His most daring move came next—launching SkyBridge Capital as a fund-of-funds platform. The company started with $450 million and made a transformative deal in 2010 by buying Citigroup’s hedge fund management unit. This strategic collaboration increased SkyBridge’s assets from $450 million to $5.9 billion overnight.

The same period saw Scaramucci create the SkyBridge Alternatives Conference (SALT) in 2009. SALT became more than an industry gathering—it served as both a financial lifeline during the 2008 crisis and SkyBridge’s main marketing tool. Wall Street leaders, political figures, and entertainment celebrities flocked to this annual Las Vegas conference, which established Scaramucci as a top financial networker[123].

SkyBridge grew substantially by 2017, managing about $12 billion in assets, which boosted Scaramucci’s net worth by a lot.

The Mooch in Politics and the Price of Power

Scaramucci’s billionaire dreams would get pricey because of politics. He joined Donald Trump’s presidential transition team in January 2017. His White House role required him to sell his SkyBridge Capital stake to avoid conflicts of interest. He arranged to sell his 44% share of SkyBridge to Chinese conglomerate HNA Group for an estimated $50-80 million.

His political gamble ended on July 21, 2017, when Trump named him White House Communications Director. His tenure became historically brief. He managed to trigger Sean Spicer’s resignation, miss his son’s birth, let loose a profanity-laden tirade against colleagues to The New Yorker, and get himself fired in just 11 days.

The rapid dismissal hit his wallet hard. Government employees can defer capital gains taxes when selling assets to take public office under IRS conflict-of-interest rules. Scaramucci’s hiring and firing happened so fast that he never received the “certificate of divestiture”. He faced an immediate tax bill of approximately $7.5-12 million on the SkyBridge sale proceeds instead of deferring taxes.

The SkyBridge-HNA deal needed approval from a government committee that assesses foreign acquisitions of American businesses. The transaction got stuck in regulatory limbo. Scaramucci headed back to SkyBridge as co-managing partner in April 2018.

“I paid the price. I’m a big boy and I moved on,” Scaramucci reflected later about his political detour. His relationship with Trump changed completely by 2024. He endorsed Kamala Harris for president and called Trump’s tariff policies “the stupidest economic policies in US history”.

Scaramucci managed to keep his financial focus through these political entanglements. This expensive political adventure wouldn’t stop his journey toward billionaire status.

Conclusion

Anthony Scaramucci’s experience from a blue-collar Long Island neighborhood to financial prominence shows a perfect example of American social mobility. His 11-day White House stint gets more attention than his business success, but his financial achievements tell an equally compelling story. His career showed remarkable resilience. He bounced back after Goldman Sachs fired him, built Oscar Capital into an $800 million success, and turned SkyBridge into a multi-billion-dollar enterprise.

Life threw challenges his way. SkyBridge’s assets dropped from $12 billion to $1.3 billion. His political gamble got pricey and left him with a multi-million-dollar tax bill. Yet Scaramucci rebuilt every time. His entrepreneurial spirit started early when he delivered newspapers as a child. This same drive pushed him forward consistently. His networking skills soared, especially when he had the SALT conference platform that helped establish his Wall Street reputation.

Scaramucci’s wealth story teaches valuable lessons about persistence. His path shows that calculated risks, strategic collaborations, and relationship-building can exceed humble beginnings. This construction worker’s son who helped build Manhattan’s skyline ended up dominating its financial towers through determination and adaptability. His story keeps evolving and proves success rarely follows a straight path, especially on the complex road to billionaire status.