In recent years, the enforcement of the Telephone Consumer Protection Act (TCPA) has led to significant legal actions against companies engaging in unsolicited communications. One notable case involves Assurance IQ, LLC, which agreed to a $21.875 million settlement following allegations of TCPA violations. This article provides an in-depth analysis of the settlement, its implications, and the broader context of TCPA enforcement.

Background of the TCPA

Enacted in 1991, the TCPA aims to prohibit unsolicited telemarketing calls, prerecorded messages, and faxes to consumers. The act bars automated dialing systems and artificial or prerecorded voice messages used without the express consent of the recipient. Violations of act can result in substantial penalties, including fines and statutory damages.

Allegations against Assurance IQ

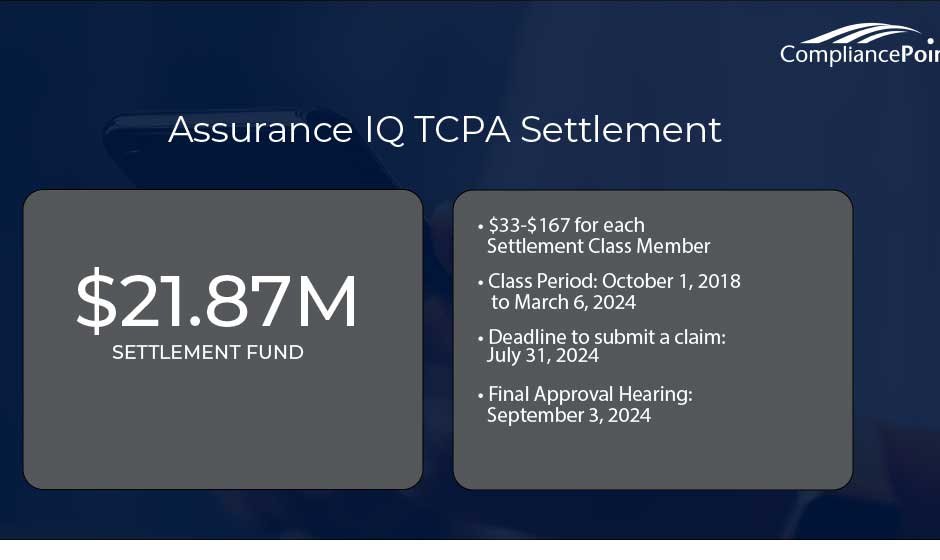

Assurance IQ LLC, an online insurance platform, was accused of violating the Telephone Consumer Protection Act (TCPA) by placing unsolicited calls using artificial or prerecorded voices without obtaining proper consent from recipients. The class-action lawsuit, titled Smith v. Assurance IQ, LLC, was filed in the Chancery Division of the Cook County Illinois Court. Plaintiffs alleged that between October 1, 2018 and March 6, 2024, Assurance IQ made numerous such calls in violation of TCPA consumer privacy rights.

Settlement Details

To resolve the allegations without admitting wrongdoing, Assurance IQ agreed to a settlement of $21.875 million. The settlement class includes all people who received unsolicited calls from Assurance IQ using artificial or prerecorded voices during the specified period. Class members were given the option to exclude themselves or object to the settlement by July 31, 2024. Final approval hearing was held September 3, 2024. Settlement payments to participating class members are slated for November 2024.

Implications for Assurance IQ TCPA Settlement

The settlement had an enormous financial impact on Assurance IQ. Reports say the company stopped operations within 60 days of the preliminary approval. Despite the shutdown, Assurance IQ’s parent company, Prudential, fulfilled the settlement payment obligations. This situation highlights the financial and operational risks companies may face when not in compliance with TCPA regulations.

Broader Impact on TCPA Enforcement

The Assurance IQ TCPA settlement underscores the need to be vigilant in enforcing TCPA regulations. And companies using telemarketing strategies must follow consent requirements to avoid similar legal challenges. This large settlement acts as a deterrent and demonstrates compliance with respect to consumer privacy.

Takeaways for Consumers and Businesses

For Consumers, the settlement demonstrates that legal frameworks like the TCPA protect their rights. Those who receive such unsolicited communications have recourse and may sue in class-action suits for compensation.

For Businesses, it illustrates how robust compliance measures should be implemented when performing telemarketing activities. Obtaining explicit consent from consumers before initiating automated or prerecorded communications reduces legal risks.

Conclusion

The Assurance IQ TCPA settlement serves as a pivotal example of the consequences companies may face when violating telemarketing regulations. It points out how important consumer consent is in communications and how the TCPA protects privacy rights. Both consumers and businesses can draw lessons from this case, emphasizing the need for awareness and compliance in the evolving landscape of telemarketing practices.