In many marriages, money is a sensitive subject. Whether it’s about how to save, spend, or invest, couples often find themselves avoiding serious conversations about finances. But avoiding these discussions can create misunderstandings and, in some cases, tension between partners. Open and honest financial communication is key to building trust and ensuring that both partners are aligned when it comes to managing money. It’s not just about budgeting or paying bills together; it’s about creating a financial partnership that strengthens your relationship.

Talking openly about money can feel uncomfortable at first, especially if one or both partners have different spending habits or financial goals. However, the benefits of establishing financial communication in marriage are clear. It can improve your financial situation, create a better sense of teamwork, and even reduce stress. In this article, we’ll explore why it’s so important to communicate about money in marriage and how doing so can make your life smoother.

Why Financial Communication Matters

At the heart of every successful marriage is trust. Just like any other aspect of the relationship, trust is essential when it comes to finances. If one partner is unsure about where the other stands financially, or if they feel like financial decisions are being made without their input, it can erode that trust. This can lead to disagreements, misunderstandings, and even long-term resentment.

It’s especially important to have open discussions about money if you’re facing challenges like debt. For instance, if one or both partners are dealing with debt, like credit card debt or student loans, avoiding the topic can make the situation worse. Working together, whether through debt consolidation or another plan, requires honest communication. The more you talk about your finances, the easier it will be to create a plan and tackle any financial challenges as a team.

By talking openly about money, you ensure that both partners are on the same page. It helps create a shared vision of financial goals, which is crucial for moving forward as a unit. Whether it’s saving for a home, building an emergency fund, or paying off debt, discussing your goals and strategies together will make achieving them much easier.

Building Trust and Reducing Financial Stress

Many people don’t realize that financial stress is a major contributor to relationship issues. Money worries can lead to anxiety, arguments, and even cause partners to feel isolated from each other. This stress often comes from a lack of communication or from one partner feeling like they’re handling the finances alone.

When you prioritize financial communication, it can reduce the anxiety that often comes with money. Regular money talks help both partners feel involved and informed about the financial situation. This shared knowledge allows both partners to feel more confident in their financial decisions and more in control of their future.

One of the most important ways to reduce financial stress is to set regular check-ins where you talk about budgeting, saving, and other financial topics. Having these regular conversations makes it easier to stay aligned and catch any potential issues before they become bigger problems. Whether it’s once a month or every few weeks, setting aside time to review your finances together can help ensure that you’re both working toward the same goals.

Tackling Financial Challenges Together

Life doesn’t always go according to plan, and sometimes couples face unexpected financial challenges, like a job loss, medical bills, or a large expense that wasn’t anticipated. When you have open communication about money, you can tackle these challenges as a team, rather than letting them drive a wedge between you.

For example, if you’re facing a financial challenge like credit card debt or medical bills, discussing options like debt consolidation together can help you both come up with a plan. By addressing the issue together, you’re not only relieving financial stress but also strengthening your partnership. You’re showing that you’re in it together, no matter what.

A key to facing financial challenges as a couple is to listen to each other’s concerns. Sometimes, one partner may feel more stressed about the finances than the other. Open conversations allow each person to express their worries, work together to find solutions, and avoid finger-pointing. When both partners feel heard and supported, it’s much easier to make informed decisions and move forward confidently.

Aligning Your Financial Goals

Every couple has different financial priorities. One person may be focused on paying down debt, while the other may be saving for retirement. While these goals may seem separate, aligning them is essential to creating a cohesive financial plan. The key to this alignment is communication.

By discussing your financial goals openly, you can create a plan that incorporates both partners’ priorities. For example, if you’re both working toward paying off debt, you can come up with a strategy together, such as consolidating loans or cutting unnecessary expenses. Similarly, if one partner is more focused on short-term savings and the other on long-term investments, discussing how to balance these goals can help ensure that you’re both contributing to the financial plan in a way that works for both of you.

Setting joint financial goals can also create a sense of teamwork and shared responsibility. When you both know what you’re working toward and why, it’s easier to stay motivated and hold each other accountable. Whether it’s saving for a vacation or planning for retirement, having these shared goals helps you both feel like you’re moving toward the same future.

Avoiding Secrets and Financial Surprises

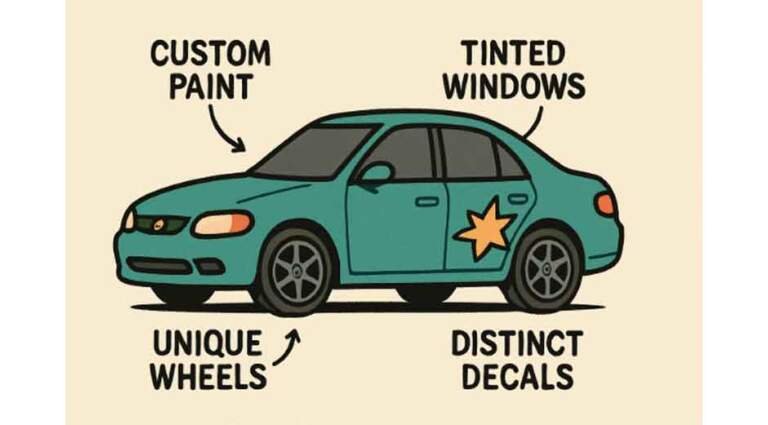

A big part of open financial communication is avoiding secrets or surprises. Unfortunately, many people are afraid to talk about money because they fear judgment or embarrassment. This might be the case if one person has hidden debt or is making a large purchase without consulting their partner.

However, keeping financial secrets can cause more harm than good. It can lead to feelings of betrayal, mistrust, and ultimately, resentment. Being transparent about your finances, no matter how difficult it may seem, is crucial for a healthy relationship. Even if there are financial issues you’d rather avoid talking about, such as a significant amount of debt, it’s better to address them together than to let them fester.

When both partners are honest about their finances, it eliminates the fear of the unknown and helps avoid surprises down the road. If you’re facing financial trouble, bringing it up early gives you both time to come up with a plan. This level of transparency strengthens the bond between you and makes it easier to address problems head-on.

Conclusion: Stronger Financial Partnerships Lead to Stronger Marriages

Effective communication is one of the cornerstones of a strong marriage. When it comes to finances, being open, honest, and proactive can make a huge difference. Financial communication not only reduces stress and anxiety but also builds trust, helps you tackle challenges together, and creates a sense of shared responsibility for your financial future.

By making financial discussions a regular part of your relationship, you ensure that you and your partner are on the same page and working toward the same goals. Whether it’s discussing debt consolidation, setting a budget, or planning for the future, prioritizing financial communication is one of the best ways to strengthen your relationship and set your marriage up for long-term success.