A car loan is one of the best ways to finance your personal or business car. However, this loan does not come free of charge. Lenders will ask you to pay an interest rate on top of your borrowed principal amount. That is known as the auto loan interest rate.

It applies to both secured and unsecured car loans. So this means that the total cost of your personal or business car will be higher when using a loan to finance it than when you pay for it in cash. Read on to learn more about this interest rate and how to calculate it.

So, what is an auto loan interest rate?

An auto loan interest rate is the cost of borrowing an auto loan from lenders. All lenders express this interest rate as a percentage form. Also, this interest rate plays a significant part in your monthly auto loan payments.

An essential thing to note is that the rate of interest you will need to pay will depend on a few factors. One of the most essential factors is whether you are getting a secured or unsecured car financing. A secured loan financing has a lower interest rate than an unsecured one. On the other hand, an unsecured car loan ensures that you can easily finance your car purchase, even when you have bad credit.

Other factors that will determine how much auto loan interest you need to pay are:

- Your credit score.

- Loan term length

- Your debt-to-equity ratio

- How much down payment you make

- Age of the car

- Auto loan environment

How to calculate an auto loan interest payments

One of the best methods you can use to calculate an auto loan’s monthly interest is through an auto loan calculator. You can find this auto loan calculator online. These calculators can help you narrow down to a loan term that fits your budget.

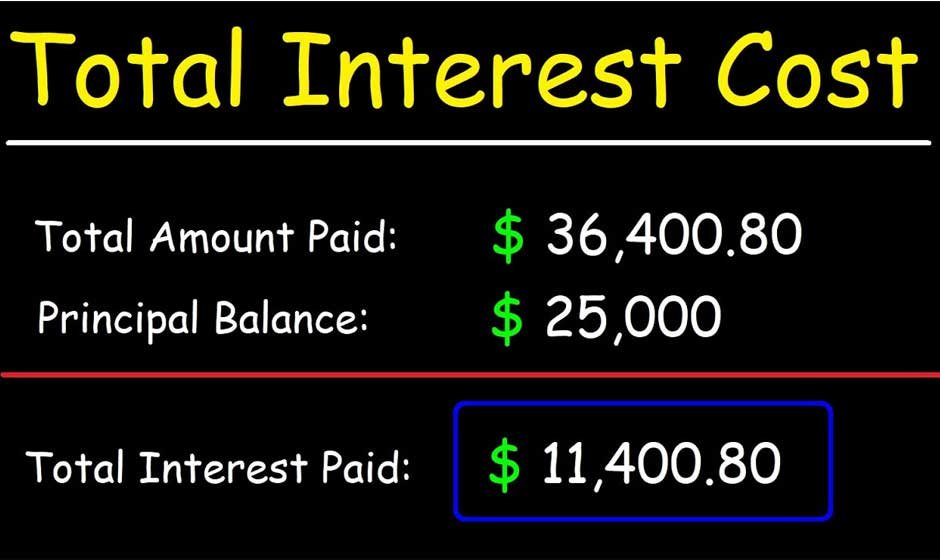

Also, the calculators will provide you with an overview of how much interest you will pay every month and for the entire loan period. To determine how much interest you will pay every month, check your calculator’s amortization schedule.

From the calculation, you will note that a part of the monthly payments goes to interest and a part to the principle. Also, note that the interest you pay each month will depend on the current loan balance of that month. Thus, you will pay a higher interest during the first months after borrowing. However, this interest will progressively reduce as you make your monthly payments.

The auto loan calculator provides one of the best ways to determine how much interest you will pay. To use these calculators, you will need to key in a few details, including:

Cost of the vehicle

This cost refers to the total amount you wish to borrow to purchase the vehicle. If you want to make a trade-in or down payment, you need to subtract the amount from the vehicle’s price. This subtraction will help you get the specific cost of your vehicle.

Auto loan term

The auto loan term refers to the time you will take to repay the car loan fully. You can use different loan terms in your calculation process to see how much interest you will get charged.

New or used

This section will require you to key in whether you wish to buy a used or new car. The new or used car detail is essential, especially if you do not know the auto loan interest rate that is in the market.

Interest rate

In this section, you must fill in the cost of auto loan borrowing in the market. You can also check your lender’s preferred interest rate online. In most cases, lenders will list the interest rate on the first page of their site. The best thing is that you can research and compare the different interest rates of various lenders.

How to reduce the amount of interest you will need to pay

Here are a few strategies you can use to reduce your monthly interest and save money.

Save for a high down payment

You will borrow less when you save for a high down payment. Borrowing less reduces your interest rate. Also, it ensures access to a much cheaper loan.

Shop for the best lenders

Note that the average percentage rate comprises the lender’s fees and the interest rate. Thus, knowing each lender’s average percentage rate can help you find an auto loan with a low total cost. Make sure to visit the website of these lending institutions for a better shopping experience.

In Conclusion

An auto loan interest rate is the cost of borrowing an auto loan from a lender. This interest depends on factors like down payment, credit score, loan term length, job history, and lender’s requirements. The best thing is that you can easily calculate how much interest you will pay monthly with an auto loan calculator.